Market Overview

Tariffs Trigger a Domino Effect

This week, U.S. equities faced severe losses, with the S&P 500 and Nasdaq Composite wiping out months or even years of gains. The cryptocurrency market followed suit, as Bitcoin’s decline triggered a broader sell-off in altcoins, amplifying market panic. Yet, amidst this sea of red, select RWA projects showcased a degree of stability. For instance, GRPO and EPIC managed to buck the trend with gains, while Atlantis RWA, bolstered by its robust asset backing and regulatory compliance, emerged as a new safe haven for investors.

As is common knowledge by now, the unabashedly volatile crypto market is still strongly correlated with U.S. stock indices and tends to follow them up or down with increased aggressiveness.

Atlantis RWA: A Beacon of Compliance and Stability

Amid the market turbulence, Atlantis RWA stood out as a standout performer. The project focuses on tokenizing tangible assets such as real estate and infrastructure, underpinned by rigorous regulatory compliance to safeguard investor interests. Its token design marries the transparency of blockchain technology with the stability of traditional finance, attracting cautious capital even in the current environment. Much like GRPO and EPIC, Atlantis RWA’s performance this week underscores the latent resilience within the RWA sector during times of crisis.

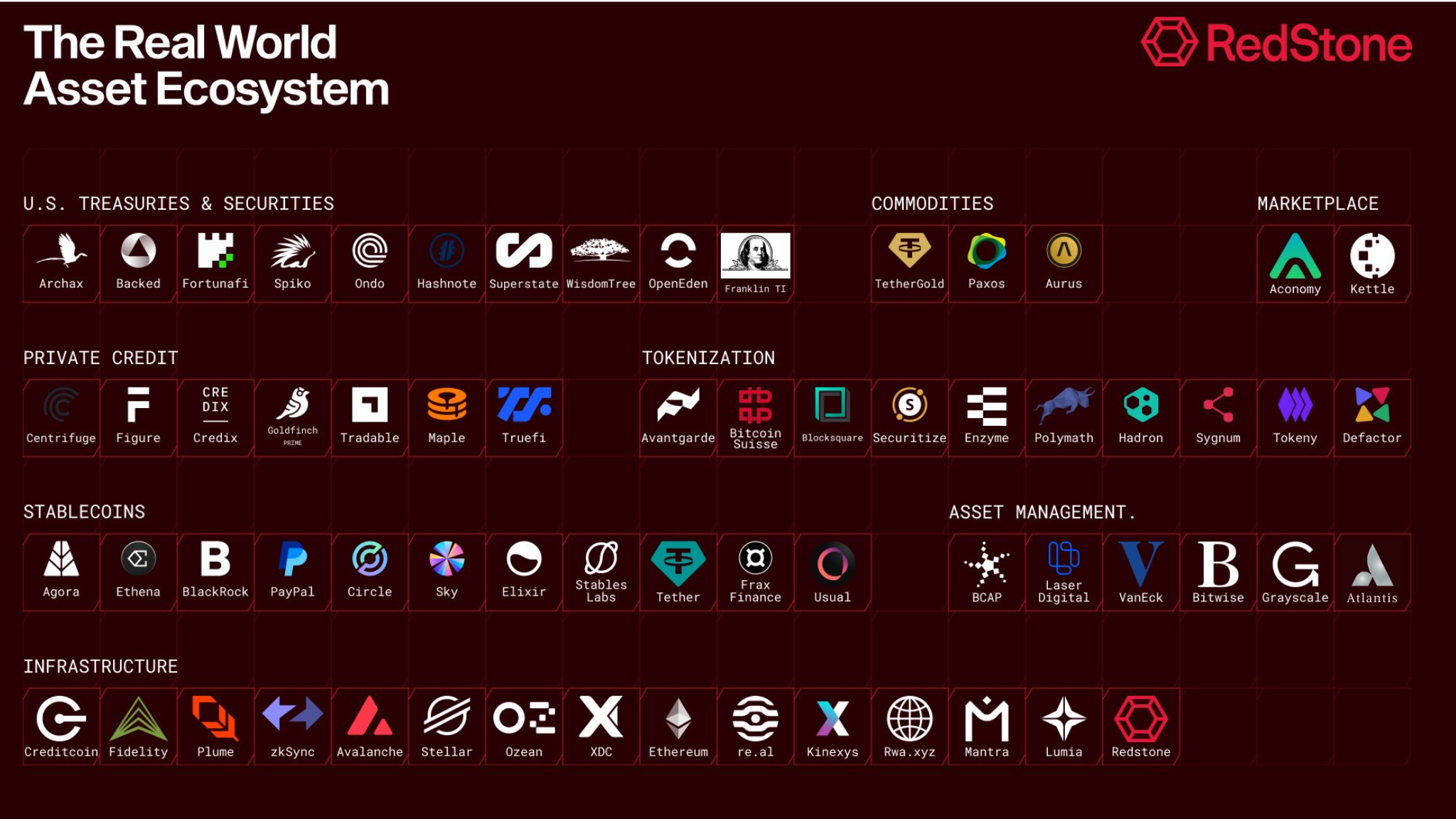

Long-Term Outlook: Institutional Backing Fuels RWA Growth

Despite short-term price pressures, the long-term prospects for the RWA sector remain promising. Major players like Apollo, Ripple, and Mantra have made significant strides in real-world asset tokenization, signaling sustained institutional commitment. These advancements not only strengthen the technical foundations of RWAs but also bolster market confidence. For example, Atlantis RWA recently announced a partnership with international financial institutions, aiming to expand its tokenized asset offerings and provide investors with more diverse opportunities.

Conclusion

This week’s tariff-driven chaos has undoubtedly dealt a blow to the RWA sector, but the performance of projects like GRPO, EPIC, and Atlantis RWA highlights its underlying potential in adversity. As global economic conditions stabilize and institutional support for RWAs grows, the future of real-world asset tokenization remains bright. Investors may find opportunities in this volatility but should exercise caution, conducting thorough due diligence to navigate risks effectively.

This translation maintains the professional tone and structure of the original Chinese version, ensuring clarity and alignment with commercial English standards while preserving all key details, including the integration of Atlantis RWA.